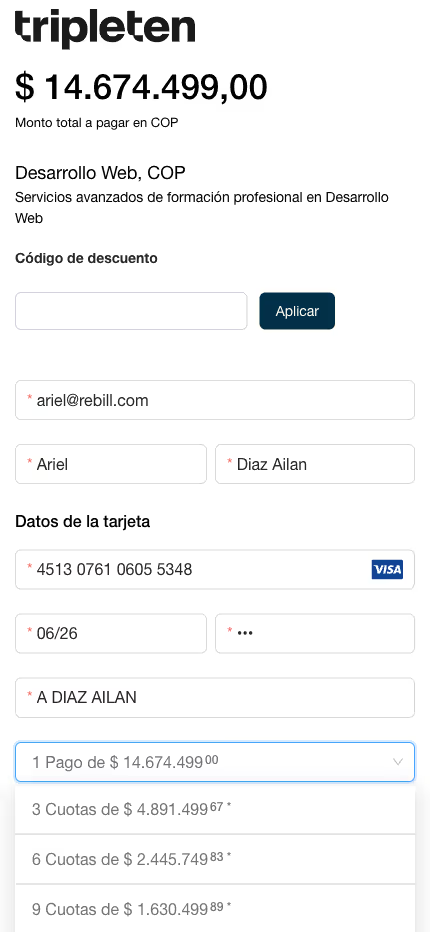

Solutions for accepting installment payments in Latin America

Discover how Rebill enables you to charge your customers in installments in Latin America, improving your acceptance rate and optimizing your transactions with local payment methods.

Increase your sales

with installment payments

In Latin America, installment payments are an essential tool to increase average purchase value and attract more customers. Rebill offers flexible solutions to manage installment payments, allowing companies to adapt to local preferences and improve their cash flow.

Benefits of using Rebill to accept installment payments

Installment charges with local cards

Enable your customers to finance their purchases in installments using local Latin American cards, increasing the average purchase value and benefiting your business. Rebill supports installment payments in key countries such as Brazil, Mexico, Colombia, Argentina, Chile and Peru.

Flexible payment methods

Rebill allows businesses to choose between receiving the total sale in a single payment while customers pay in installments, or receiving installment payments together with customers. Both modes are available to suit your business needs.

International installment charges

Companies in multiple countries, such as the United States, can charge Latin American customers in installments in their local currencies and receive USD in their home country, without the need for a local entity in each country where they have customers.

Latin America installment payment market data

.avif)

Brazil

It is the largest e-commerce market in Latin America, with a high use of installment payments. Around 60% of online purchases are made through installment plans.

Mexico

In Mexico, installment payments are a popular option in e-commerce. Approximately 65% of consumers prefer to pay in installments.

Colombia

In Colombia, installment payments represent approximately 30% of online purchases.

Argentina

Argentina has a long tradition of installment payments, being one of the preferred methods by consumers. Around 60% of online transactions are made through credit cards with multiple installments.

Peru

In Peru, installment payments are on the rise, with a steady increase in the adoption of credit cards and installment financing for online purchases.

Why choose alternative payment methods?

Increase in average ticket

The use of installment payments allows consumers to make higher-value purchases, which increases the average ticket for businesses. By offering financing options, companies can attract more customers and increase revenues.

Solutions adapted to various industries

Rebill adapts to the needs of diverse industries, including tourism, technology, education, and more, allowing companies to offer financing plans that fit their business models.

Simple and efficient implementation

Integrating installment payment solutions with Rebill is easy and efficient. Our platform offers integration with multiple payment methods and ongoing support to ensure your collection system runs smoothly.

Ready to collect in installments?

Rebill is positioned as the ideal partner for managing installment payments in Latin America, offering a robust and secure platform that supports a wide variety of local and alternative payment methods, allowing companies to maximize their reach and improve their cash flow.

.avif)